Summary

As 2023 began, the global equity markets faced multiple risks, causing investors to take a generally pessimistic view of the year ahead. After a tumultuous 2022 and aggressive monetary tightening in the developed countries to stem the highest rate of inflation in decades, the consensus was that the global economy would plunge into recession sooner rather than later. Instead, the world’s economies proved to be unexpectedly resilient, and the global stock markets ended the year sharply higher. Moreover, some indexes flirted with, or even exceeded, their all-time highs.

A recap of the fourth quarter of 2023

The quarter began with a turbulent October. The global stock markets fell, dragged down by concerns that central banks’ higher-for-longer interest rate policies might tip the global economy into recession as well as by the rising geopolitical risks in the Middle East. The opposite occurred in November, when the global markets mounted a significant recovery. Their performance was due mainly to the decline in bond yields , as investors became convinced that the U.S. Federal Reserve (Fed) and other central banks were on the verge of winning the fight against inflation, and doing so in a smooth manner. The upward trend continued in December after the Fed decided to keep the key rate unchanged at its last meeting of the year. In the projections released after the meeting, Fed officials even signalled that rate cuts were on the way in 2024. This prospect drove the global equity indexes to all-time highs, with the markets pricing in significant easing of financial conditions by the world’s major central banks in the coming months.

| Variation Q4-2023 |

Variation 1 year |

|

|---|---|---|

| Indexes (%) | ||

| Canadian bonds | ||

| FTSE Canada Universe Bond | ||

| FTSE Canada Universe Bond | 8,3 ▲ | 6,7 ▲ |

| Canadian equities | ||

| S&P/TSX Composite | ||

| S&P/ TSX Composite | 8.1 ▲ | 11.8 ▲ |

| U.S. equities (CA$) | ||

| S&P 500 | ||

| S&P 500 | 8.9 ▲ | 22.9 ▲ |

| Global equities (CA$) | ||

| MSCI Asia Pacifis (all countries) | ||

| MSCI Asia Pacific (all countries) | 5.3 ▲ | 8.8 ▲ |

| MSCI Europe | ||

| MSCI Europe | 8.4 ▲ | 17.4 ▲ |

| MSCI World (ex. Canada) | ||

| MSCI World (ex. Canada) | 8.8 ▲ | 21.4 ▲ |

| MSCI Emerging Markets | ||

| MSCI Emerging Markets | 5.3 ▲ | 7.3 ▲ |

Sources: FTSE International Limited, S&P Dow Jones Indices LLC and MSCI Inc.

| Closing 31-12-23 |

Variation Q4-23 |

Variation 1 year |

|

|---|---|---|---|

| Interest rate in Canada (%) | |||

| Key rate | |||

| Key rate | 5.00 | 0.00 ▲ | 0.75 ▲ |

| Commodities ($ US) | |||

| Oil (WTI) | |||

| Oil (WTI) | $71.89 | -21.6% ▼ | -10.6% ▼ |

| Gold | |||

| Gold | $2,060.96 | 9.7% ▲ | 13.7% ▲ |

| Currencies | |||

| EUR/CAD | |||

| EUR/CAD | 1.46 | -1.2% ▼ | 1.2% ▲ |

| JPY/CAD | |||

| JPY/CAD | 0.01 | 1.9% ▲ | -9.4% ▼ |

| USD/CAD | |||

| USD/CAD | 1.32 | -2.7% ▼ | -2.4% ▼ |

Sources: Bank of Canada, Fundata, U.S. Energy Information Administration.

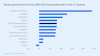

Net of fees returns as of 31 december 2023 (%)

Source: Trust National Bank.

Fixed income

Canadian fixed income

Bond investors had a tough two years, with no improvement in the situation until the start of the fourth quarter. However, the Canadian fixed income market closed 2023 on a remarkable note: the FTSE Canada Universe Bond Index posted a quarterly return of 8.3%. The gain was due mainly to the decline in bond yields throughout the fourth quarter. For example, 10-year bond yields fell about 90 basis points during the quarter, causing bond prices to rise.

Several factors caused the yield curve to decline. First, the Canadian economy had begun to show signs of slowing; its growth contracted unexpectedly in the third quarter and came to a standstill in October, according to Statistics Canada. Second, the central bank’s messaging changed during the quarter. Like the Fed, the Bank of Canada (BoC) opted to stand pat at its last meeting in December. Moreover, its officials even disclosed that they had become more optimistic about the inflation outlook.

Outlook

At the start of the quarter, many investors thought the bond market hadn’t looked as attractive in years, after its historic rout in 2022. The outlook was therefore generally positive. Short- and long-term interest rates appeared to have peaked at the end of the third quarter of 2023, and inflation, as measured by the Consumer Price Index (CPI), was showing encouraging signs in Canada.

Even so, the risk that rates will go back up is not zero. Inflation is still above its target range of 1% to 3%. The BoC has not yet declared victory and is not closing the door to further rate hikes if inflation resumes. Economic data releases will continue to be closely monitored, especially the unemployment rate, which serves as a leading economic indicator.

That being said, economic momentum is showing signs of slowing and helping ease the pressure on the BoC to keep raising its rates.

STOCK MARKETS

.

Canadian equities

The Canadian stock market returned 8.1% in the fourth quarter, as measured by the S&P/TSX Composite Index.

Investors enthusiasm for artificial intelligence drove tech stocks higher in 2023. U.S. Big Techs, such as Alphabet, Amazon.com and Meta Platforms, as well as semiconductor companies, such as NVIDIA and Advanced Micro Devices, made headlines on a number of occasions. The information technology sector of the Canadian market was not to be outdone; it also benefited greatly from the frenzy, even outperforming its U.S. peers. The information technology sector of the S&P/TSX Composite Index ended the year with a quarterly return of almost 25% and nearly 70% for the full year. Lightspeed Commerce and Shopify led the sector with quarterly gains of about 45% and 39%, respectively.

U.S. equities

The U.S. market also enjoyed a strong fourth quarter, with the S&P 500 Index posting a nine-week winning streak and even approaching the all-time high reached in January 2022. Ultimately, the S&P 500 returned 8.9% in Canadian dollars, although the gains were reduced by the loonie’s strength against the greenback. Interestingly, U.S. equities were led throughout the year by a rise in the so-called Magnificent Seven, the largest companies in the S&P 500 by market capitalization, spurred by the rise of artificial intelligence and signs that the Fed would start cutting interest rates in 2024. NVIDIA, Meta Platforms and Tesla more than doubled in 2023 (in U.S. dollars).

The resilience of the U.S. economy was especially surprising because the consensus at the start of 2023 was that the economy would enter a recession during the year. Today, the consensus is that the U.S. economy could be on its way to a soft landing – a scenario whereby an economy slows in a gradual and controlled manner without entering a recession.

In recent months, economists have even revised their U.S. GDP growth forecasts for 2024 upward. We note, however, that optimism about a soft landing and the outlook for the U.S. economy is confined mainly to the United States.

Avoiding a recession after such aggressive rate hikes is no easy task. Since the 1980s, the Fed has managed to raise interest rates only once without causing the U.S. economy to slide into a recession. That was in 1995. Even so, the rate hikes that began in 1994 had an adverse impact on the stock and bond markets.

International and emerging equities

European equities also benefited from the signals that the major central banks were about to ease monetary policy, especially the European Central Bank. Moreover, the outlook for German investors improved amid signs that Europe’s largest economy may stabilize as inflation eases. The MSCI Europe Index ended the period with an 8.4% gain for Canadian investors.

The Asian market ended the fourth quarter with a return of 5.3% in Canadian dollars, as measured by the MSCI All Country Asia Pacific Index. Japan contributed the most to the return; the world’s third-largest economy is experiencing the fastest inflation in more than 30 years, mainly because of rising wages. Such inflation is favourable for the country because it signals a recovery in growth after years of deflation or moderate inflation. The economic outlook for Japan is therefore favourable. At the end of December, the government revised its 2023 economic growth forecasts upward. Investors foresee a change of course by the Bank of Japan, which is expected to abandon its ultra-accommodative monetary policy and to ease its yield curve control.

This performance contrasts sharply with China’s. The country faces many challenges: a crisis in the real estate sector, a painful recovery in manufacturing, a loss of investor confidence in its growth potential and possible deflation. Deflation refers to a general, persistent decrease in the prices of goods and services in an economy. In the case of China, it is due to weak domestic demand.

Even so, the MSCI Emerging Markets Index ended the quarter with a gain of 5.3% in Canadian dollars, led by Taiwan and South Korea, both of which benefited greatly from the information technology sector’s outperformance, linked to the development of artificial intelligence.

Equity market outlook and risks

Investors’ outlook for 2024 is mixed, especially in the United States. As noted, the market has priced in a soft landing for the U.S. economy and further growth in 2024. That being said, some observers think that it’s still too early to declare victory, arguing that the risk of recession remains and is perhaps even underestimated. The trade war with China shouldn’t be overlooked, and one of its consequences could be a resumption of inflation. Elsewhere in the world, recession is still very much in the realm of possibility.

One thing is certain: Investors expect monetary policy to ease and interest rates to fall in 2024. It remains to be seen whether their expectations will be aligned with central bank actions and what the pace of the cuts will be. Lowering rates too quickly could fuel inflation, while lowering them too slowly could cause economies in recession to stumble under the weight of interest rates.

Desynchronization of central bank actions could also have a significant impact on the global economy, contributing to disparities in economic growth rates between countries and regions. It could also lead to significant exchange rate fluctuations and therefore affect international trade, increasing or decreasing the competitiveness of exports and imports. Capital flows may also be affected as investors turn to countries with higher interest rates, which could increase financial market volatility.

Finally, geopolitical risks remain high. The war in Ukraine, which began almost two years ago, the situation in the Middle East and new tensions in the Red Sea cannot be overlooked.

Conclusion

Trying to time the market is a risky and difficult exercise – 2023 being a perfect example. The consensus was quite clear: The global economy was heading for a recession and the money market had never looked more attractive. Even so, bonds continued to fall for most of the year, while stocks rose under the impetus of the artificial intelligence frenzy.

That being said, economic forecasts involve many factors, and historical comparisons are almost non-existent. The takeaway? Make sure your investments are tailored to your risk tolerance and liquidity needs, while maintaining a long-term perspective to achieve your goals.

Contact us

To discuss the markets and your investment strategy, contact your Financial Planner and Mutual Fund Representative of FÉRIQUE Investment Services, main distributor of FÉRIQUE Funds.

| Private Wealth T 514 840-9204 Toll free 1 855 337-47833 gestionprivee@ferique.com |

Advisory Services |