Summary

Volatility returned in the third quarter; sometimes the market was convinced that the fight against inflation was over and the U.S. economy might even experience a rare soft landing, and sometimes it fretted that continuing inflationary pressures would prompt the central banks to continue their monetary tightening cycle and would increase the risks of recession.

At the start of the quarter, the markets were increasingly optimistic that the Fed had completed its monetary tightening cycle without hitting hard on the US economy. Still, given the resilience of the economy, this sentiment gradually dissipated. Such resilience suggests that inflation will stay above the Fed’s 2% target, which would encourage it to keep its rates higher for longer than expected. Even so, the market rebounded at the end of August after economic data showed that the U.S. labour market was starting to find a better balance and that some inflationary pressures were easing, including wage pressures. The situation reversed itself in September after the Fed’s latest meeting, when officials said they would keep rates higher for longer. This announcement served as a reality check for the markets, which had been expecting interest rate cuts in the coming months. The quarter ended with a broad-based decline on the world’s major stock markets.

| Variation Q3-2023 |

Variation 1 year |

|

|---|---|---|

| Indexes (%) | ||

| Canadian bonds | ||

| FTSE Canada Universe Bond | ||

| FTSE Canada Universe Bond | -3.9 ▼ | -1.4 ▼ |

| Canadian equities | ||

| S&P/TSX Composite | ||

| S&P/ TSX Composite | -2.2 ▼ | 9.5 ▲ |

| U.S. equities (CA$) | ||

| S&P 500 | ||

| S&P 500 | -1.2 ▼ | 19.7 ▲ |

| Global equities (CA$) | ||

| MSCI Asia Pacifis (all countries) | ||

| MSCI Asia Pacific (all countries) | -0.5 ▼ | 14.6 ▲ |

| MSCI Europe | ||

| MSCI Europe | -2.8 ▼ | 27.6 ▲ |

| MSCI World (ex. Canada) | ||

| MSCI World (ex. Canada) | -1.2 ▼ | 21.0 ▲ |

| MSCI Emerging Markets | ||

| MSCI Emerging Markets | -0.7 ▼ | 10.4 ▲ |

Sources: FTSE International Limited, S&P Dow Jones Indices LLC and MSCI Inc.

| Closing 30-09-23 |

Variation Q3-23 |

Variation 1 year |

|

|---|---|---|---|

| Interest rate in Canada (%) | |||

| Key rate | |||

| Key rate | 5.00 | 0.25 ▲ | 1.75 ▲ |

| Commodities ($ US) | |||

| Oil (WTI) | |||

| Oil (WTI) | $91.71 | 31.8% ▲ | 15.4% ▲ |

| Gold | |||

| Gold | $1,878.60 | -2.3% ▼ | 12.4% ▲ |

| Currencies | |||

| EUR/CAD | |||

| EUR/CAD | 1.43 | -1.0% ▼ | 6.7% ▲ |

| JPY/CAD | |||

| JPY/CAD | 0.01 | -1.3% ▼ | -4.6% ▼ |

| USD/CAD | |||

| USD/CAD | 1.35 | 2.1% ▲ | -1.4% ▼ |

Sources: Bank of Canada and Fundata

Net of fees returns as of 30 september 2023 (%)

Source: Trust National Bank

Fixed income

Canadian fixed income

The Canadian fixed income market ended the third quarter lower, with the FTSE Canada Universe Bond Index returning -3.9% on the period.

This performance was due once again to a readjustment of interest rate expectations in Canada and the United States in particular. At the beginning of 2023, the market thought interest rates would stabilize toward the end of the third quarter or even start to fall. The opposite happened, however. The Bank of Canada (BoC) raised its key interest rate by another 25 basis points in mid-July, taking it to 5%, its highest level in more than 20 years. This decision was expected by the market owing to the resilience of the Canadian economy and persistent inflationary pressures in some key sectors, such as services (restaurants, car maintenance and hair salons). As a result, bond yields rose sharply in September in response to the still-hawkish rhetoric from the central banks, especially the Fed.

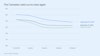

Long-term inflation expectations, the economic growth outlook and the central banks’ ability to manage rate hikes are factors reflected in the longer end of the yield curve. The 10-year government bond yields is typically used to represent these expectations.

As shown above, the rise in Canadian government bond yields reflects expectations that rates are likely to remain high and largely explains the decline in bond prices.

Outlook

Why have expectations continued to adjust since the start of the tightening cycles undertaken by the BoC and the Fed?

Let’s go back to the beginning of 2022. Interest rates were still at historically low levels, and inflation, as measured by the consumer price index, had already exceeded 5% year over year, for the first time in more than 30 years. The central banks argued that the surge in prices, driven by supply-chain disruptions and billions of dollars in stimulus, was transitory and would largely fade on its own. Even so, it soon became clear that this bout of inflation was much more difficult to forecast and to control, not least because of unpredictable new external shocks, such as the war in Ukraine. Toward the end of 2022, the market was expecting the central banks to slow their rate hikes or even to start reversing them over the course of the year, so as not to cause too much of an economic slowdown, or even a recession.

Since the beginning of 2023, inflation has declined but is still showing signs of stickiness because the economy has been resilient and the job market has been strong despite the sustained hikes. The economy’s resilience has come as a surprise. The short-term, optimistic nature of the markets sees it as the indication of a better outlook: rate hikes will not adversely affect the economy as much as expected. But the resilience is also the reason why inflation is sticky and yields aren’t falling. The charts below shows the changes in these expectations, on a year-to-date and even month-to-month basis.

That being said, interest rates may have peaked. Economic data releases will be closely watched, particularly those related to the labour market, such as the unemployment rate. These data will influence central bank decisions.

STOCK MARKETS

.

Canadian equities

The Canadian stock market returned -2.2% for the third quarter as measured by the S&P/TSX Composite Index. Even though the Canadian economy showed its first signs of slowing when GDP contracted in the second quarter of 2023, interest rates rose once again amid core inflation that remained relatively high. Inflation was even up slightly in August, with the significant increase in oil prices during the quarter being a contributing factor. As well, the market suffered when the Canadian banks reported disappointing results because of unexpected increases in their loan-loss provisions, which also signalled weaknesses in the Canadian economy.

U.S. equities

As already noted, the Fed’s latest comments served as a reality check for investors. Rates will stay higher for longer, and market expectations readjusted accordingly. The frenzy surrounding developments in artificial intelligence also faded during the quarter. As a result, the S&P 500 Index returned -1.2% in Canadian currency.

This loss was mitigated by the U.S. dollar’s strength in the third quarter. Once again, the resilience of the U.S. economy was the factor, for it prompted the Fed to keep rates high. As a result, the greenback tended to rise as high rates attracted more capital from foreign investors looking for higher returns. The slowing of global growth, especially in Europe and China, accentuated this phenomenon.

International and emerging equities

Pessimistic forecasts for the global economy as well as persistently high inflation in the euro zone depressed the European market in the third quarter. The European Central Bank’s continued hawkish rhetoric also weighed on the region’s economic outlook. The MSCI Europe Index ended the period with a return of -2.8% in Canadian currency.

Asian and emerging market equities fared better. The MSCI All Country Asia Pacific Index and the MSCI Emerging Markets Index ended the quarter with returns of -0.5% and -0.7%, respectively, in Canadian currency. These markets benefited greatly from strong performances by India and Japan. In contrast, recession risks and weaker global demand weighed on the Taiwanese and South Korean markets, especially in the information technology sector.

Despite a volatile quarter, China ended the period relatively flat. In July, hopes that the government would announce measures to stimulate domestic consumption buoyed the market. That being said, the lack of significant economic stimulus from the government, another round of disappointing economic data and concerns about the Chinese property market weighed on investor sentiment.

Stock market outlook and risks

Nearly 18 months after the Fed began its monetary tightening cycle, economic uncertainty remains high and the most anticipated recession of all times seems more distant than was forecast. The likelihood of a recession, or at least a slowdown, remains high, and the disparity of expectations, in terms of its magnitude and timing, is still widely debated. So far, the resilient U.S. economy and strong job market have continued to surprise. But was it really justified, or even prudent, to think the Fed would take a short-term view and cut rates, as the markets were hoping?

On average, it takes 18 to 24 months for the impact of rate hikes to be felt in the economy, particularly in the job market. So, the Fed’s hikes, which began in 2022, won’t be fully felt until the end of this year or early in 2024.

At the end of the second quarter, observers wondered whether the risks of inflation, interest rate hikes and recession were properly priced into the market. These risks now seem to be better taken into account, including the risk that rates will remain higher for longer.

Conclusion

Persistent inflation in the developed markets is weighing on the global growth outlook and investor sentiment. Better-than-expected economic data are usually good news. That being said, the current good news can be perceived as a signal that rates aren’t restrictive enough. The balance between the two is subtle, and their interrelationship is increasing stock market volatility. The role of portfolio managers is to select quality companies that can navigate and adjust to all kinds of economic environments, including the one we find ourselves in today.

Establishing long-term perspectives can be challenging when events and risks are constantly changing over short periods. That’s why it’s vital to stay the course. A financial planner can help you create an investment plan tailored to your risk tolerance and needs with a view to achieving your goals over the long term.

Contact us

To discuss the markets and your investment strategy, contact your Financial Planner and Mutual Fund Representative of FÉRIQUE Investment Services, main distributor of FÉRIQUE Funds.

| Private Wealth T 514 840-9204 Toll free 1 855 337-47833 gestionprivee@ferique.com |

Advisory Services |